When you are shopping for auto insurance, the terms uninsured automobilist( UM) and underinsured automobilist( UIM) content might come up, and you may be wondering if they’re really necessary. In a perfect world, everyone would have acceptable auto insurance content, but the reality is that accidents be, and occasionally the other motorist does n’t have the content demanded to pay for the damages. That’s where uninsured and underinsured automobilist content can help.

In this composition, we’ll break down what uninsured and underinsured automobilist content is, how they work, and why they’re important for guarding you and your passengers in the event of an accident.

What’s Uninsured Motorist Coverage?

Uninsured automobilist content( UM) is an insurance policy provision that protects you in the event of an accident caused by another motorist who does n’t have insurance. While utmost countries bear motorists to carry a minimal position of bus insurance, there are still numerous people on the road who are uninsured, either by choice or because they ca n’t go insurance.However, your uninsured automobilist content way in to fill the gap, If an uninsured motorist hits you and does n’t have the fiscal means to cover your medical bills or auto repairs.

crucial Points About Uninsured Motorist Coverage

Covers you if the other motorist has no insurance This type of content helps pay for medical charges, property damage, and occasionally lost stipend if you’re in an accident caused by someone who does not carry insurance.

Applies to hit- and- run accidents UM content can also be useful if you are the victim of a megahit- and- run accident where the at- fault motorist flees the scene, leaving you with no way to identify them or pursue compensation.

needed in some countries Some countries have laws that bear motorists to carry uninsured automobilist content as part of their minimum content. Indeed in countries where it’s not obligatory, it’s a wise option to consider.

What’s Underinsured Motorist Coverage?

Underinsured automobilist content( UIM) is analogous to uninsured automobilist content, but it applies when the at- fault motorist has insurance, but not enough to completely cover the costs of your medical bills and damages. In numerous cases, motorists may have the state- needed minimum content, which frequently is n’t enough to pay for serious injuries or expansive property damage in an accident.

For illustration, if you are hit by another motorist who has only the minimal liability content needed by law( say,$ 25,000 for fleshly injury), but your medical bills total$ 50,000, UIM content would cover the remaining$ 25,000, helping to pay the difference.

crucial Points About Underinsured Motorist Coverage

Helps cover the gap UIM content can help cover the difference between what the at- fault motorist’s insurance pays and the factual cost of your damages.

Protects you in serious accidents If you are seriously injured in an accident and the at- fault motorist’s insurance is inadequate to cover the full cost of your medical treatment, UIM content helps insure you do n’t have to pay out of fund for those charges.

Not always needed While numerous countries bear uninsured automobilist content, underinsured automobilist content is frequently voluntary, although it’s still recommended to have it for added protection.

How Do Uninsured and Underinsured Motorist Coverage Work Together?

In some cases, a single accident may involve both uninsured and underinsured automobilist content. Then’s an illustration of how they can work together

Let’s say you’re involved in a collision with a motorist who does n’t have insurance( uninsured), but they’re at fault.However, it would pay for your medical bills and property damage, If you have uninsured automobilist content. still, if the at- fault motorist has insurance, but it is n’t enough to cover your damages( underinsured), you would calculate on your underinsured automobilist content to make up the difference.

Some insurance programs combine both uninsured and underinsured automobilist content under a single marquee. Other programs may offer them as separate options. Either way, having both is generally a good idea, as it provides comprehensive content in a variety of situations.

Why Do You Need Uninsured and Underinsured Motorist Coverage?

Uninsured and underinsured automobilist content are essential for several crucial reasons

1. Protection from the Financial Impact of Accidents

Accidents can be financially ruinous, especially if you’re seriously injured and the other motorist does n’t have enough insurance( or any at each) to cover your medical charges, lost stipend, and form costs. Without UM or UIM content, you may be left paying out- of- fund for these charges.

2. Hit- and- Run Accidents

While numerous motorists will have insurance, there are cases where the other motorist flees the scene, leaving you without any expedient for recovering your damages.However, you may not have any way to cover your costs, If you do n’t have uninsured automobilist content. UM content can help in these situations.

3. The Low Probability of Acceptable Coverage

In some countries, the minimal bus insurance content needed by law may not be enough to cover the damages in an accident. For illustration, if the minimal demand for liability insurance is$ 25,000 but your medical bills exceed that quantum, you could end up with a significant fiscal burden. UIM content helps help this issue.

4. More Common Than You suppose

According to the Insurance Research Council, nearly one in eight motorists on the road are uninsured. In addition, numerous further motorists carry only the minimal quantum of liability insurance needed by their state, which may not be enough to completely compensate victims in the event of an accident. Having uninsured and underinsured automobilist content helps insure you’re covered in these situations.

5. State Conditions

Some countries bear uninsured and underinsured automobilist content as part of their minimal bus insurance requirements.However, you’ll need to carry them, but indeed if they’re not needed, If you live in a state where these contents are obligatory.

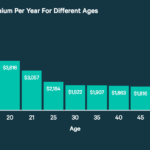

Uninsured and Underinsured Motorist Coverage and Your Insurance Premiums

Like any other form of auto insurance, uninsured and underinsured automobilist content will affect your decorations. The cost of these contents generally depends on several factors, including

State laws In countries where uninsured or underinsured automobilist content is obligatory, it may be included in your decoration at a set rate.

Your driving history motorists with a clean record may see lower decorations for this content, while those with a history of accidents or violations may see advanced rates.

Coverage limits The advanced the content limits you choose for UM and UIM, the advanced your decorations will be. still, concluding for advanced limits can give you with better protection in case of an accident.

While uninsured and underinsured automobilist content can add to the overall cost of your decoration, the protection it offers can be inestimable if you’re involved in an accident with someone who lacks acceptable insurance.

How to Add Uninsured and Underinsured Motorist Coverage to Your Policy

Adding UM and UIM content to your auto insurance policy is generally a simple process.However, you can generally call your agent or log into your account to add or acclimate these contents, If you’re formerly working with an insurance company. When opting limits, keep in mind the implicit costs of medical treatment, property damage, and lost stipend. immaculately, you should carry enough content to cover the full extent of your implicit damages in the event of an accident.

still, ask about the vacuity and costs of uninsured and underinsured automobilist content, If you’re shopping for a new policy. It’s also a good idea to ask for recommendations on how important content is applicable for your situation.

Conclusion

Uninsured and underinsured automobilist content are important additions to your auto insurance policy that can give pivotal protection in the event of an accident. They cover you when the at- fault motorist either has no insurance or inadequate content to pay for your medical charges and property damage. While these contents may increase your decoration, the peace of mind they give is well worth the investment.

When shopping for auto insurance, be sure to precisely consider your state’s conditions and your own requirements. Adding UM and UIM content can insure that you’re defended on the road, no matter who’s at fault in an accident.