When you drive a auto, you not only have the responsibility to operate it safely but also to insure that you’re financially defended in case commodity goes wrong. That’s where machine insurance comes in. Whether you are a new motorist or simply looking to brush up on your knowledge, understanding the basics of bus insurance is pivotal. Then is a detailed breakdown of what you need to know.

What’s Automobile Insurance?

machine insurance is a contract between you( the policyholder) and an insurance company. In exchange for regular payments, known as decorations, the insurance company provides fiscal protection in the event of an accident, theft, or other incidents that involve your vehicle.

While the specific content varies depending on the policy, utmost bus insurance plans are designed to cover damage to your auto, damage to other people’s vehicles or property, medical charges, and indeed legal costs if you are set up responsible for an accident.

Key Components of Auto Insurance

Auto insurance generally consists of several types of content, and each bone addresses different aspects of implicit threat. Then are the main factors

Liability Insurance

Liability insurance is frequently a obligatory demand in numerous countries. It covers damages you beget to other people and their property in an accident where you’re at fault. There are two main types

Bodily Injury Liability Covers medical charges and implicit legal freights if you are at fault for injuring someone in an accident.

Property Damage Liability Pays for the cost of repairs to someone differently’s vehicle or property that you damage in an accident.

Collision Coverage

Collision content pays for damage to your vehicle performing from a collision, anyhow of who’s at fault. This is important if you want to repair or replace your auto after an accident with another vehicle or an object like a tree or rail.

Comprehensive Coverage

Comprehensive content offers protection for damages not caused by a collision. This includes incidents like vandalization, theft, natural disasters( hail, cataracts, etc.), or beast- related accidents( hitting a deer, for illustration).

particular Injury Protection( PIP)

PIP covers medical charges for you and your passengers if you are injured in an accident, anyhow of who was at fault. It can also cover misplaced stipend and other out- of- fund charges that affect from the injury.

Uninsured/ Underinsured Motorist Coverage

still, this content helps pay for the damages, If you are involved in an accident with someone who does n’t have insurance( or does not have enough insurance). It can cover both fleshly injury and property damage.

Medical Payments Coverage

This type of content helps pay for medical charges after an accident, anyhow of fault. It’s analogous to PIP, but PIP tends to be more comprehensive, covering fresh charges like lost stipend and child care.

How decorations Are Determined

Your insurance decoration is the quantum you pay to the insurance company for content, generally on a yearly or periodic base. Several factors determine how important you’ll pay for bus insurance, including

Driving History If you have a clean driving record, you are likely to pay lower decorations. A history of accidents or violations( like speeding tickets) will probably affect in advanced rates.

Vehicle Type The make, model, and age of your auto can impact your rates. For case, luxury buses , sports buses , or vehicles with high form costs generally come with advanced decorations.

position Where you live matters.However, your decorations may be advanced due to the increased threat of accidents or theft, If you live in a megacity with a high crime rate or a lot of business.

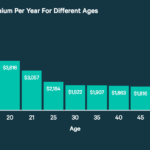

Age and Gender youngish motorists, especially those under 25, generally pay advanced decorations due to a advanced threat of accidents. also, youthful manly motorists generally pay further than womanish motorists.

Credit History In some countries, insurers may use your credit score as a factor in setting rates. Those with better credit may get lower decorations, as statistics show they tend to file smaller claims.

Deductibles The deductible is the quantum you agree to pay out- of- fund before your insurance kicks in. concluding for a advanced deductible can lower your yearly decoration, but it also means you’ll have to pay further if you need to file a claim.

minimal Conditions vs. Full Coverage

In the U.S., every state has a minimal position of auto insurance content that motorists must have in place to fairly drive on public roads. This generally includes liability insurance, but the quantum of content needed can vary from state to state.

While meeting the minimal conditions is enough to stay legal, numerous motorists conclude for full content insurance for further protection. Full content generally includes liability, collision, and comprehensive content. It’s more precious but can be inestimable if you are involved in an accident.

The significance of Having Auto Insurance

There are several compelling reasons why having bus insurance is essential

Legal Protection In utmost countries, driving without insurance is illegal, and you can face forfeitures, license suspense, or indeed jail time if caught. also, if you are involved in an accident without insurance, you could be tête-à-tête responsible for all the damages, which can be financially ruinous.

Financial Protection Insurance helps cover form costs, medical bills, and indeed legal freights, depending on your policy. Without it, you could end up paying out- of- fund for charges that can fluently reach thousands of bones .

Peace of Mind Knowing that you have protection in place gives you peace of mind while driving. Accidents be, and being set financially can take a lot of stress out of a stressful situation.

guarding Others Auto insurance is n’t just about guarding yourself. It’s about guarding others on the road, too. With liability insurance, you help cover the costs of damage to someone differently’s vehicle or medical charges if you are at fault in an accident.

Conclusion

machine insurance is a vital part of responsible auto power. It protects you from significant fiscal losses caused by accidents, theft, and other unanticipated events. While there are colorful types of content, liability insurance is generally the bare minimum, and fresh content options like collision, comprehensive, and particular injury protection can give further thorough protection.

When choosing a policy, it’s important to understand your requirements, estimate your budget, and shop around for the stylish rates. Whether you are looking for minimal content or full protection, make sure you’re adequately covered to cover both yourself and others on the road.