When shopping for bus insurance, you may have noticed that your age, gender, and connubial status play a part in determining how important you’ll pay for content. It can feel a bit puzzling at first — why would being a certain age, gender, or connubial status affect your rates? Understanding these factors can help you make further informed opinions about your insurance and potentially save plutocrat.

In this composition, we’ll explore how age, gender, and connubial status influence bus insurance rates and what you can do to work with these factors when opting your policy.

How Age Affects Auto Insurance Rates

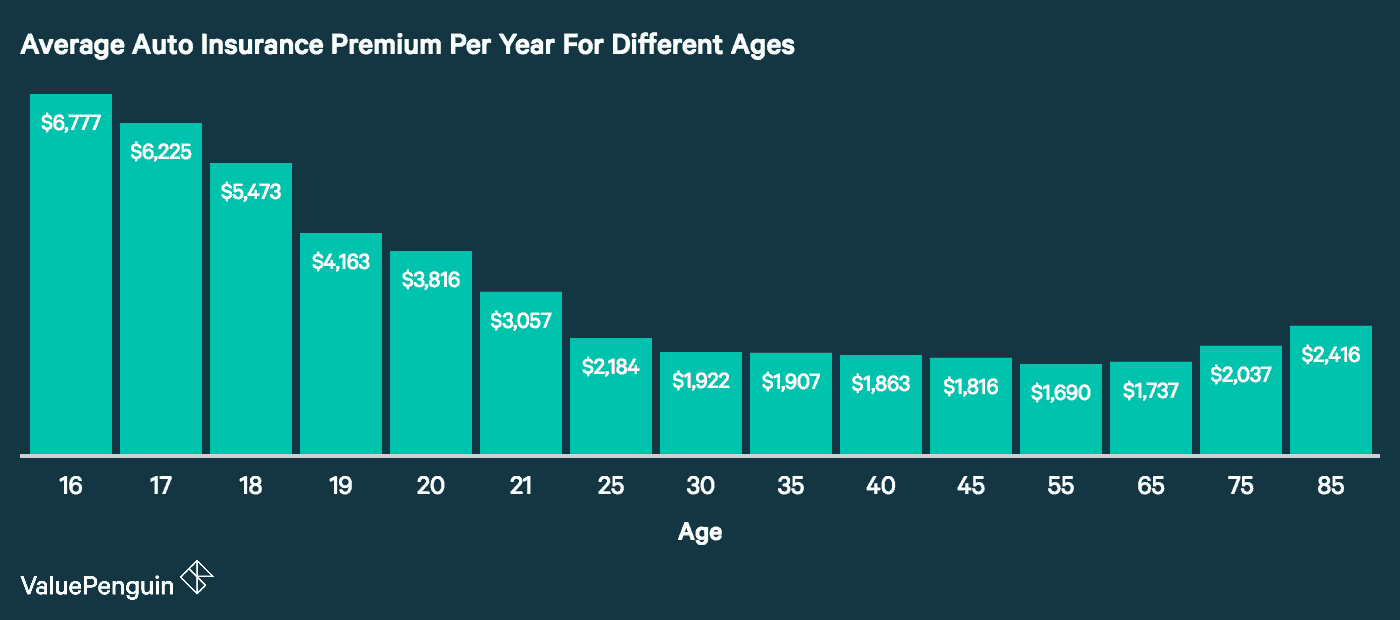

Age is one of the most significant factors impacting bus insurance rates. Insurance companies predicate their pricing on statistical data, and when it comes to age, the data tells insurers that certain age groups are more likely to be involved in accidents than others. This threat is reflected in the cost of decorations.

Then’s how different age groups are generally affected by bus insurance

Teen motorists( Under 25)

still, particularly a teen, you’ll likely face the loftiest bus insurance decorations, If you’re under 25. Teenagers are statistically more likely to be involved in accidents due to inexperience behind the wheel, as well as parlous driving actions like speeding, distracted driving, and not wearing seat belts.

High- threat group Insurance companies consider teen motorists as high- threat, which results in significantly advanced decorations.

Why the cost is so high Young motorists frequently warrant the experience and judgment that aged motorists develop over time, which makes them more likely to beget accidents. also, they’re more prone to making parlous opinions while driving, similar as texting or driving too presto.

youthful Grown-ups( 25- 30)

Once you hit 25, your decorations generally start to drop, though you may still pay advanced rates compared to aged motorists. By this age, utmost motorists have gained a many times of experience, and statistically, they’re less likely to get into accidents.

Lower rates While still fairly youthful, motorists in theirmid-20s are generally considered less parlous. Insurers frequently offer abatements to motorists who reach this corner age, reflecting advanced safety records as you develop.

More driving habits By age 25, you’ve probably developed safer driving habits, which insurers see as a positive change.

Middle- progressed motorists( 30- 50)

motorists between the periods of 30 and 50 tend to witness some of the smallest bus insurance rates. This age group is considered to be more educated and responsible behind the wheel. generally, they’re less likely to be involved in accidents, and their threat of reckless driving is lower compared to youngish motorists.

Stable rates Premiums for middle-aged motorists are generally stable, as this group is seen as both educated and responsible.

Smaller accidents Statistically, motorists in this age range are less likely to file claims, leading to a reduction in insurance costs.

elderly motorists( Over 65)

While aged grown-ups are frequently seen as safer motorists due to their experience, they can face advanced rates once they pass a certain age. Seniors are more likely to be involved in accidents due to slower response times, vision impairments, or health- related issues.

Implicit rate increases After 65, decorations may rise due to the increased liability of accidents. still, numerous insurance companies offer elderly abatements for motorists over 55 who take a protective driving course.

Driving restrictions Some seniors may limit the quantum of driving they do or avoid driving at night, which could help reduce their decorations.

How Gender Affects Auto Insurance Rates

Historically, gender has played a part in determining bus insurance rates, though some of the impact has lessened in recent times. Insurers consider gender- grounded statistical data, as studies have shown that men and women tend to drive else in terms of threat factors.

Men Advanced decorations

Generally, men tend to pay advanced decorations than women, especially when they’re youngish. The primary reason is that statistically, men, particularly youthful men, are more likely to engage in high- threat actions like speeding, driving under the influence, and being involved in further accidents.

parlous geste Men, especially in their teens and twenties, have advanced accident rates and are more likely to be involved in business violations and parlous driving actions.

Advanced costs for youthful men Because youthful men are considered advanced- threat motorists, they generally face advanced decorations than women in the same age group.

Women Lower decorations( originally)

Women, on the other hand, tend to pay lower decorations, especially in their youngish times. Statistically, women are less likely to be involved in serious accidents, and they’re frequently seen as more conservative motorists.

Safer driving record Women generally have smaller accidents and business violations than men, making them a lower- threat group for insurance companies.

Age matters This difference is most conspicuous in youthful grown-ups( under 25), where women generally have lower rates than men of the same age group.

still, it’s important to note that gender- grounded pricing has come less significant over time due to changes in regulations. Some countries, similar as California, Michigan, and Pennsylvania, have banned the practice of using gender as a factor in determining bus insurance rates. In these countries, both men and women pay the same rates for the same content.

How connubial Status Affects Auto Insurance Rates

Marital status is another factor that can impact your bus insurance decoration. Statistically, wedded motorists are considered less parlous than single motorists, which frequently results in lower decorations.

wedded motorists Lower decorations

In general, wedded motorists tend to pay lower for bus insurance than their single counterparts. Insurers see wedded people as more stable and responsible, and they’re statistically less likely to be involved in accidents.

Lower threat of accidents Married couples are frequently viewed as more conservative motorists. With two people in the ménage, it’s probably there will be more participated driving liabilities, reducing the chances of one person being on the road constantly, which lowers accident threat.

Abatements for couples numerous insurance companies offer a “ wedded motorist ” reduction, which can lead to significant savings on your decoration.

Single motorists Advanced decorations

Single motorists, particularly youngish, unattached individualities, tend to have advanced decorations. Insurers consider single motorists to be advanced threat, particularly youthful, manly, or unattached individualities. While marriage itself does n’t guarantee safe driving, the overall statistics show that single motorists are more likely to engage in parlous geste , similar as speeding or driving at night.

Perceived advanced threat Statistically, single individualities, especially those in their teens or 20s, are more likely to be involved in accidents or business violations.

Other Factors That Can Affect Auto Insurance Rates

While age, gender, and connubial status have a significant impact on your bus insurance rates, they’re by no means the only factors insurers use to calculate decorations. Then are a many other rudiments that play a part

Driving History A clean driving record can lead to lower decorations, while business violations or accidents can drive your rates up.

Type of Auto precious buses or buses that are more likely to be stolen generally come with advanced decorations. On the other hand, vehicles with good safety conditions oranti-theft features can lower your rates.

Credit Score In utmost countries, insurance companies use your credit score as one factor in determining your decoration. motorists with good credit scores frequently pay lower rates.

position Where you live can affect your rates. For case, civic areas with heavy business and advanced crime rates may lead to advanced decorations compared to pastoral areas.

How to Lower Your decorations Despite Age, Gender, and Marital Status

While you ca n’t change your age, gender, or connubial status, there are still ways to keep your decorations affordable

Maintain a clean driving record Avoid accidents and business violations to keep your rates low.

Pack programs numerous insurance companies offer abatements for speeding bus insurance with other programs, like homeowners or renters insurance.

Take a protective driving course Some insurers offer abatements if you complete an approved protective driving course, particularly for aged motorists.

Drive a safe vehicle Choose a auto with good safety features, similar as airbags,anti-lock thickets, and stability control.

Increase your deductible Raising your deductible can lower your yearly decoration, but make sure you’re set to cover the advanced out- of- fund costs in case of a claim.

Conclusion

Age, gender, and connubial status are all factors that play a significant part in determining your bus insurance decorations. While youngish motorists and men tend to pay advanced decorations, married individualities may profit from lower rates due to the perceived lower threat. still, the good news is that there are plenitude of other ways to lower your decorations, anyhow of these demographic factors. By maintaining a clean driving record, shopping around for quotations, and considering ways to reduce your content or increase your deductible, you can find a policy that fits your budget and life.