When your teen gets behind the wheel for the first time, it’s an instigative corner for both them and you. still, along with the freedom that comes with driving comes a responsibility that involves further than just tutoring your child the rules of the road. As a parent, one of the biggest enterprises you will face is how to manage your teen’s auto insurance. Teen motorists are statistically more likely to be involved in accidents, which makes their auto insurance decorations significantly advanced compared to adult motorists. Understanding the sways and outs of teen auto insurance can help you navigate this process and make sure your teen is covered duly, without breaking the bank.

In this composition, we’ll cover the crucial effects parents need to know about teen motorists and auto insurance, including how decorations are calculated, the stylish types of content for youthful motorists, and tips for keeping costs down.

Why Are Teen motorists’ Insurance decorations So High?

Teen motorists are considered a high- threat group by insurance companies for several reasons. The primary factor is the lack of experience behind the wheel. Driving requires not just chops, but also judgment and mindfulness, which are developed over time. Teen motorists are statistically more likely to be involved in accidents due to inexperience, threat- taking geste , and indeed distractions like texting while driving.

Then are the crucial reasons why teen motorists pay further for insurance

1. Inexperience

Teenagers are new to driving and have n’t had the time to develop the revulsions and decision- making chops that more educated motorists have. This makes them more prone to crimes that can lead to accidents.

2. threat- Taking Behavior

Young motorists are statistically more likely to engage in parlous actions like speeding, running red lights, and not wearing seat belts. Studies have shown that teen motorists frequently take more chances on the road, which raises their threat of being involved in an accident.

3. Advanced Accident Rates

Insurance companies calculate heavily on statistics, and the data shows that teen motorists are involved in a advanced chance of crashes compared to aged motorists. This advanced threat means that insurance companies need to charge advanced decorations to cover implicit claims.

4. Distractions

Teenagers are more likely to get detracted while driving, whether by musketeers, music, or mobile phones. Distractions are a leading cause of accidents, and teens are more prone to them.

How important Does Insurance Cost for Teen motorists?

On average, the cost of adding a teen motorist to a auto insurance policy can be relatively precious. In fact, decorations for teens can increase by as important as 50 to 200 depending on their age, gender, and the type of content chosen. For illustration, if a teen is added to their parent’s policy, the overall decoration for the family might increase by around$ 2,000 to$ 3,000 per time. The exact increase depends on several factors, similar as

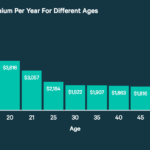

Age of the Teen The youngish the motorist, the advanced the decoration. A 16- time-old will generally have advanced rates than a 19- time-old due to the lesser perceived threat of accidents at the youngish age.

Gender In utmost cases, teen boys tend to pay further than teen girls, as manly motorists are statistically involved in further accidents and tend to take further pitfalls on the road.

Type of Auto The make, model, and time of the auto the teen drives will also impact the decoration. Sports buses or buses with high form costs generally affect in advanced decorations.

Driving Record A clean driving record will lower decorations, while any violations( like speeding tickets or accidents) will drive rates up.

Though the costs can feel inviting, there are ways to manage these charges.

Types of Coverage for Teen motorists

When adding a teen to your auto insurance policy, it’s important to consider what type of content is applicable for them. Generally, auto insurance is made up of a many crucial factors

1. Liability Coverage

Liability content is needed by law in utmost countries and helps pay for damages if your teen causes an accident. This content pays for injuries and property damage that your teen may beget to others.However, fleshly injury liability and property damage liability are the crucial contents that will cover other motorists, If your teen is responsible for an accident.

2. Collision Coverage

Collision content is important if your teen’s auto is involved in a crash, anyhow of who’s at fault. It helps pay for the form or relief of the auto. For a teen with a newer auto or bone that’s still precious, collision content might be a good option. still, for aged buses that are n’t worth much, you may want to consider dropping collision content to save plutocrat.

3. Comprehensive Coverage

Comprehensive content is also recommended, as it covers damage to your teen’s auto fromnon-collision-related events like theft, vandalization, natural disasters, or hitting an beast. Again, whether or not this content is necessary depends on the value of your teen’s auto.

4. particular Injury Protection( PIP) or Medical Payments

In the event of an accident, particular Injury Protection( PIP) or medical payments can help cover medical charges for the teen motorist and passengers, anyhow of who’s at fault. This type of content is especially useful if the teen does n’t have good health insurance.

5. Uninsured/ Underinsured Motorist Coverage

Uninsured and underinsured automobilist content protects your teen in case they’re involved in an accident with a motorist who does n’t have enough insurance to cover the damage or medical costs. This is important for teen motorists, as they may be more likely to be in accidents with other inexperienced motorists.

Ways to Lower Insurance Costs for Teen motorists

While adding a teen to your policy will probably increase your rates, there are several ways you can reduce the cost of their insurance decorations

1. Add Them to Your Policy

Rather than copping a separate policy for your teen, adding them to your being bus insurance policy is generally the most cost-effective option. numerous insurers offer amulti-driver reduction when you add a teen to your policy, which can help reduce the cost.

2. Choose a safe-deposit box, Low- Cost Auto

The type of auto your teen drives will affect the decoration. conclude for a safe, dependable, and affordable auto rather than a sports auto or luxury vehicle. Safe buses with high safety conditions and low form costs generally come with lower decorations.

3. Encourage Safe Driving

Breeding good driving habits in your teen ca n’t only make them safer on the road, but it can also help lower their insurance decorations over time. numerous insurance companies offer good pupil abatements for teens who maintain a certain GPA( generally 3.0 or advanced), as this reflects responsible geste . also, some insurers offer safe motorist abatements for teens who complete a motorist’s education or protective driving course.

4. Increase Deductibles

adding the deductible on your policy( the quantum you pay out of fund in case of a claim) can lower your decorations. still, keep in mind that this will increase your eschewal- of- fund charges if your teen is involved in an accident, so be sure to balance the savings with your capability to cover the deductible.

5. Use Telematics or Tracking bias

Some insurance companies offer programs where you can install a telematics device in your teen’s auto to track their driving geste . These bias cover speed, retardation, and other driving habits, and offer abatements for safe driving. Some companies indeed give apps that allow you to cover your teen’s driving in real- time.

6. Consider Pay- Per- Mile Insurance

still, a pay- per- afar insurance plan might be an option, If your teen does n’t drive frequently. These programs charge grounded on the number of long hauls driven, so if your teen only drives short distances, it could affect in savings.

The significance of Communication and Setting Boundaries

Away from the practical aspects of auto insurance, it’s pivotal to have an open discussion with your teen about the liabilities that come with driving. Set clear rules and boundaries about effects like

detracted driving Make it clear that texting or using the phone while driving is n’t respectable.

Speed limits insure your teen understands the troubles of speeding and the significance of adhering business laws.

Driving with passengers Some countries have restrictions on the number of passengers a teen motorist can have in the auto. Set guidelines for how and when your teen can drive with musketeers.

Insurance counteraccusations Help your teen understand that their driving geste can impact insurance rates, and encourage them to drive safely to keep decorations low.

Conclusion

For parents, dealing with auto insurance for a teen motorist can be a stressful and precious part of raising a teenager. still, by understanding the factors that affect insurance rates, choosing the right content, and following strategies to lower costs, you can make this experience more manageable. Flash back that safe driving habits and setting clear boundaries with your teen can also help minimize threat and potentially lower insurance decorations in the long run.

By working together with your teen to insure they understand their liabilities on the road — and with their auto insurance — you can help them navigate this instigative new chapter safely and affordably.